salary to afford 700k house uk

How much can I borrow on 100k salary. A 1 million mortgage would require 6k-7k per month in payments for a 30 year note.

Self Build Homes Find Out What Your Budget Can Build Homebuilding

That would mean you need a gross annual income of 247133 or a gross monthly income of 20594 to afford a 700k mortgage.

. Someone who earns 70000 a year will make about 5800 a month before taxes. Mortgage 5 Times Salary. The Income Needed To Qualify for A 500k Mortgage.

To achieve that your annual salary after tax would need to be at least 28000 depending on your financial circumstances. Would buying a house between the prices of. It is very hard for an.

So the annual income youll need to pull off a 700k mortgage comfortably is 280000. Email the 70000000 Mortgage Calculation to yourself. Answer 1 of 6.

Mortgage 6 Times Salary. Ive been looking at different houses in the UK to rent mainly in the larger cities eg Manchester London etc. The income needed for a 700k mortgage would be 234000 a year if you were to go by the mortgage-to-income ratio.

House price inflation really kicked off from about the late 70s to early 80s. I know that property taxes in the US in many states are an order of magnitude higher than in the UK. Being able to borrow a lot more meant that houses cost a lot more.

With a mortgage at 275 pa. Affordability Rule Of Thumb. 300 A Month.

700000 15 105000 which gives you a required mortgage of 595000 so I would imagine that you would want a total income of 200k. With a 10 deposit contribution worth just over 68000 the maximum affordable property price would be 682000. A good rule of thumb is that the maximum cost of your house should be no more than 25 to 3 times your total annual income.

Use the mortgage calculator to provide an illustration of monthly repayment amounts for different terms and interest rates on a 70000000 mortgage. I agree with most here. This page will calculate how much you need to earn to buy a house that costs 700000.

Borrowing Based on Salary. Cant afford a mortgage. And as someone said you would have to have a 10-20 deposit.

Rental Payments and Mortgages. Just to add to this as a couple of people have said that a 700000 property is a substantial one with one adding anywhere in the country and that is simply not true. However assuming you were in a position to look for such a house it might be conceivable that you would have a larger deposit and therefore.

Take a few days and mull over whether you really want to commit to that monthly interest repayment before you commit to the Mortgage. This figure does not take into account other financial commitments you may have for example a student loan. Mortgages at 7 times income.

I think the reason for that was being allowed to by then take what a woman earned into the mortgage calculation. Mortgage 3 times salary. Assuming that you could get a mortgage of four times your salary that you would get the maximum government loan of 40 under the London help-to-buy scheme and you would put the whole of your.

However some recommend that the mortgage must be 25 times or lower your yearly income. Stamp Duty Land Tax most people just call it stamp duty is calculated in bands which means you pay different rates on different portions of the property price. It will depend on how much of a deposit youve got and how high the property taxes are.

Say the combined salary of people living there is 90000 - 180000. Answer 1 of 18. A house that we bought for 32K in 1976 we sold for 145K in 1981.

4x Salary Income needed 45x Salary Income needed 5x Salary Income needed 55x Salary Income needed 6x Salary Income needed 400000. You can use the above calculator to estimate how much you can borrow based on your salary. 100000 annual gross income at 30 2500 per month.

Based on 90 mortgage with an example 45 interest rate over 25 years. This means that if you wanted to purchase a 500K home or qualify for a 500K mortgage your minimum salary should fall between 165K and 200K. How much house you can afford depends less on your gross monthly income and more on how much income you keep every month by not having high debt obligations.

Salary needed for 700000 dollar mortgage. LTV stands for Loan-to-Value. The monthly mortgage payment would be 2437.

It assumes a fixed-rate mortgage. Mortgage 55 times salary. 601562 108335 for a house specifically Cambridge.

The table below shows how much you need to earn depending on the income multiple used by a lender for a 400k mortgage. In the home counties and especially Surrey 700k will get you just a 3 bedroom house. WellI would assume that you would already be earning before the 80K mark and that you would probbably also have a spouse who also earns.

For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage. Mortgages based on 4-45 times salary. Generally lend between 3 to 45 times an individuals annual income.

The most expensive cities to buy property in the UK average house cost versus salary London. These homes are bought by people who have incomes deep into six figure AND have accumulated equity in previous homes. Therefore in those states where property.

Personal finance experts recommend spending between 25 and 33 of your gross monthly income on housing. Debt To Income Ratio. Having 400k in equity from a previous home can push the monthly bill closer to 4000 per month.

Keep reading to learn all things you would need. Mortgage lenders in the UK. This equates to a loan amount of 614000.

To afford a house that costs 700000 with a down payment of 140000 youd need to earn 104450 per year before tax. Houses in London are extremely expensive with 700000 still being a terraced house with less space than elsewhere.

Better Com Ipo What You Need To Know Forbes Advisor

Case Study Should I Move Or Should I Extend My Home Extension

Looking To Buy A Home For 800 000 Here S What You Can Expect To Find The Washington Post

Looking To Buy A Home For 600 000 Here S What You Can Expect To Find The Washington Post

Median Home Price Could Fall Below 1m In Sydney And About 700 000 In Melbourne Next Year Housing The Guardian

Mortgage House Payment Calculator Forbes Advisor

In The Uk To Afford A House Worth 700 000 Roughly What Income Do Both Spouses Need To Be Earning Quora

Family Who Earn 200k A Year And Have 700k House Claim To Be Struggling Uk News Express Co Uk

What You Need To Earn To Buy A House In Every Major Canadian City Workopolis Blog

Looking To Buy A Home For 800 000 Here S What You Can Expect To Find The Washington Post

Looking To Buy A Home For 800 000 Here S What You Can Expect To Find The Washington Post

Looking To Buy A Home For 800 000 Here S What You Can Expect To Find The Washington Post

Should I Sell My House Now 2021 Pros Cons Zillow

Are We In A Housing Bubble Or Blip We Ve Got The Answers Forbes Advisor

Pin By Jim Hicks Home Improvement On Dream Homes Expensive Houses Albemarle House

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/F6GAE6Z3LFA3M5VB7ZVQ4B5R2M.jpg)

What Salary Will Buy A Typical House Around Ireland The Irish Times

In The Uk What Types Of House A Mechanical Engineer With 20 Years Of Experience Can Afford Quora

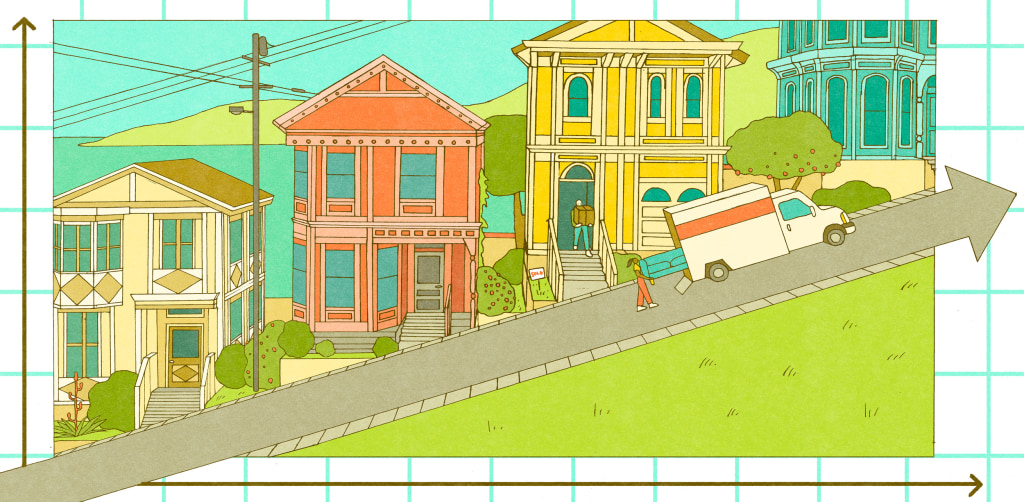

Bidding Wars And Meaningless List Prices Buying A House In The Bay Area